The Overlooked Investment Wisdom of "Expectations Investing" by Michael J. Mauboussin

"Invert, always Invert". - CM

"Expectations Investing" by Michael J. Mauboussin and Alfred Rappaport sheds light on a crucial aspect often overlooked in company analyses—market expectations. The book introduces a unique valuation model, the "reverse DCF," which aims to estimate market expectations implicit in the stock price.

The review of the book will follow this structure:

Brief Introduction

Expectations Investing: The Importance of Expectations

The Problem with Multiple Analysis

Valuation and the Business

The Cash Flow

The Process

Final Considerations

Brief Introduction

"Expectations Investing" by Michael J. Mauboussin and Alfred Rappaport was first released on September 10, 2001, a day before the Twin Towers attack and the beginning of a three-year Bear Market. Over the past 20 years, the market and global economies have undergone various transformations, with many leading companies today not even in existence at that time.

Therefore, "Expectations Investing" received a new version in 2021, incorporating updates, especially due to changes in the accounting landscape and cost of capital.

In the last decade, there has been a prevalence of investment in intangible assets over tangible CapEX, making expectations about a company's future cash flow more relevant than its actual assets, especially concerning technology companies.

Expectations Investing: The Importance of Expectations

The central idea of "Expectations Investing" is that investing relies on expectations. Similar to the phrase "Satisfaction equals outcome minus expectation," market expectations are based on a company's long-term cash flows, and each expectation revision is crucial for stock price movements.

The book emphasizes that investors need to comprehend what is implied in a stock's price—what those prices genuinely reflect about the agents' expectations. In this regard, a good investment isn't necessarily a "cheap" or "discounted" stock but one that consistently surpasses market expectations.

The Problem with Multiple Analysis

While many investors staunchly advocate for valuation metrics, the authors argue that multiple analyses are merely a "shortcut" to the company valuation process. When stating that a stock is, for example, trading at 4x P/E, various assumptions are implicitly made.

These assumptions reflect expectations, such as a projection of a certain cash flow, a specific revenue growth rate, a particular return on invested capital, and so on. Often, these assumptions don't materialize, or the company undergoes a multiple contraction.

Valuation and the Business

One significant point raised by the authors is the evaluation of a company in conjunction with its competitive strategy. Valuation and business strategy analysis are typically taught separately, but the authors argue that it's impossible to value a company without understanding its competitive business strategy.

Investors need to understand the "unit economics" of the business—how a company makes money per store, per acquired customer, etc. The competitive advantage or MOAT can make a significant difference in stock valuations.

The Cash Flow

Contrary to short-term results, multiples, or valuation metrics, the authors highlight the importance of future cash flow for determining a company's value.

What "Expectations Investing" Highlights?

Quoting John Bogle: "Sooner or later, the rewards of investing must be related to future cash flows." In the second chapter, a flowchart illustrates how value moves from a company's operations to the shareholder:

Key observations include:

Sales growth and operational profit margin determine operational profit.

Operational profit minus tax obligations leads to NOPAT (Net Operating Profit After Tax).

NOPAT minus investments in capital-intensive and fixed assets results in free cash flow.

Discounting the cost of capital from free cash flow yields the company's value.

The company's value, when added to non-operational assets and subtracted from debt value, equals the shareholder's remaining value.

The Process

A significant portion of the book is dedicated to demonstrating step-by-step how the "Expectations Investing" process works. In summary, the method comprises three steps:

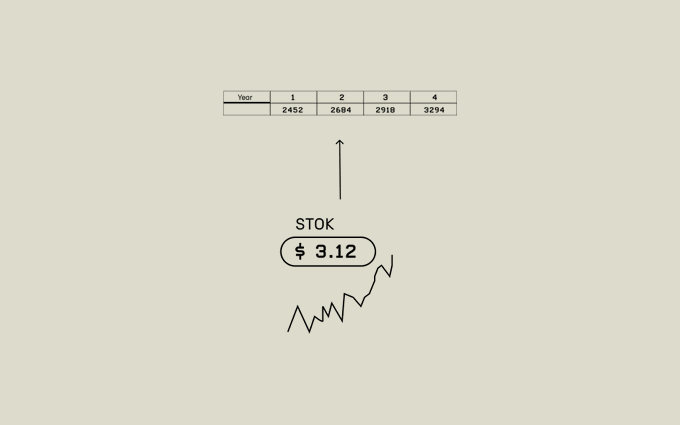

Estimate implicit expectations in the price: Instead of projecting future cash flows and arriving at a target price, the market price is taken as a given, and the expectations adopted for the cash flows implicit in the price are estimated.

Identify opportunities where expectations are distorted: Once expectations are estimated, the goal is to find companies where there might be a revision of expectations.

Example: A company X, given its current market price, may have an implied revenue growth of 10% per annum, but it is likely to achieve much higher growth.

Buy, sell, or neutral? There are patterns for the decision to buy or sell a stock. A stock to be bought must offer a good margin of safety, with a significant discount to its expected value to compensate for any setbacks the company may encounter. A stock to be sold, on the other hand, must offer a much higher premium over its expected value.

Final Chapters

After the seventh chapter, alternative methods beyond the traditional discounted cash flow (DCF) are presented for evaluating companies. There is a special chapter on real options valuation, as well as a special section on M&As and how it's possible to anticipate the market's reaction to an acquisition announcement.

In conclusion, the book, despite its brevity, provides useful tools, especially for modeling technology or high-growth companies. Understanding what is implied in the prices of these companies is crucial not only for finding good opportunities but also for avoiding significant losses. The book's website offers free access to a series of 10 tutorials containing a step-by-step guide to valuing Domino's Pizza, including the spreadsheets.

Practical Insights: Petrobras ($PBR)

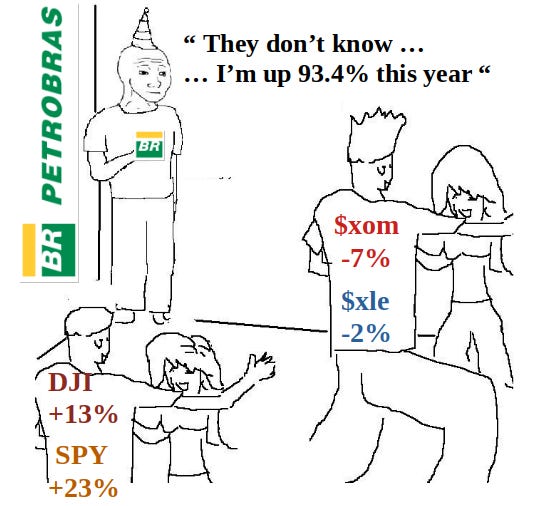

Let's delve into a concrete case to illuminate a practical application of Expectations Investing, using Petrobras (PBR) as our subject. The intriguing aspect here is the stark contrast in valuations and the implicit political risk premium.

Petrobras vs. Russian Stocks: A Tale of Relative Valuations

In the given timeframe, Petrobras found itself in a unique position, trading at a valuation that seemed incongruent with its inherent political risks. What made this scenario even more fascinating was the relative comparison with Russian stocks.

Unraveling the Discrepancy: While Petrobras faced its fair share of political uncertainties, the market priced these risks in a manner that seemed disproportionate. Astonishingly, Petrobras, despite its political challenges, was valued more attractively than certain Russian counterparts. This apparent contradiction shed light on the misalignment between implied political risk and market realities.

Questioning Implicit Assumptions: Expectations Investing encourages investors to question these implicit assumptions. In this case, it prompted a closer examination of whether the perceived political risk in Petrobras justified its pricing compared to companies in regions renowned for political volatility.

A Remarkable Surge: Following this period of undervaluation, Petrobras (PBR) experienced a remarkable surge in its stock value, ultimately achieving an appreciation of over 90%. This substantial uptick underscored the potency of uncovering and challenging market expectations.

This practical example not only highlights the initial valuation discrepancy but also showcases the substantial gains that can result from astute expectations investing.